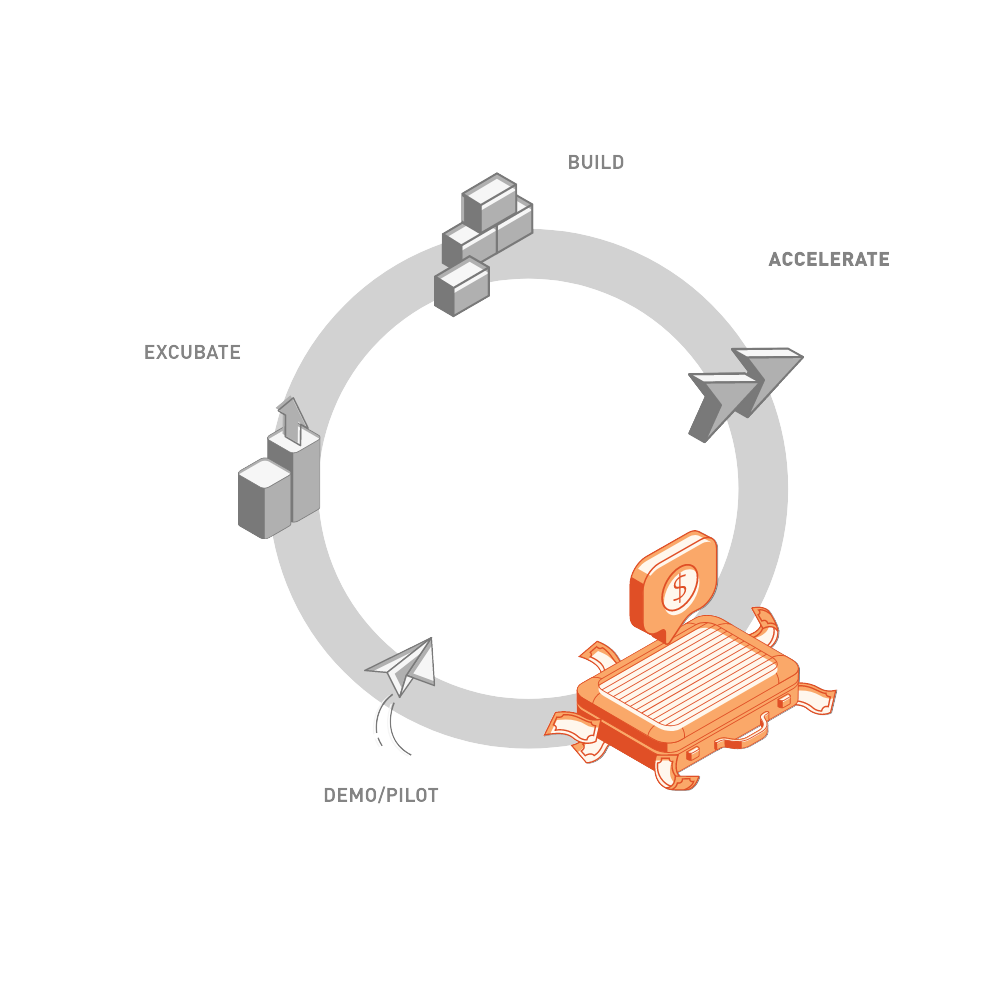

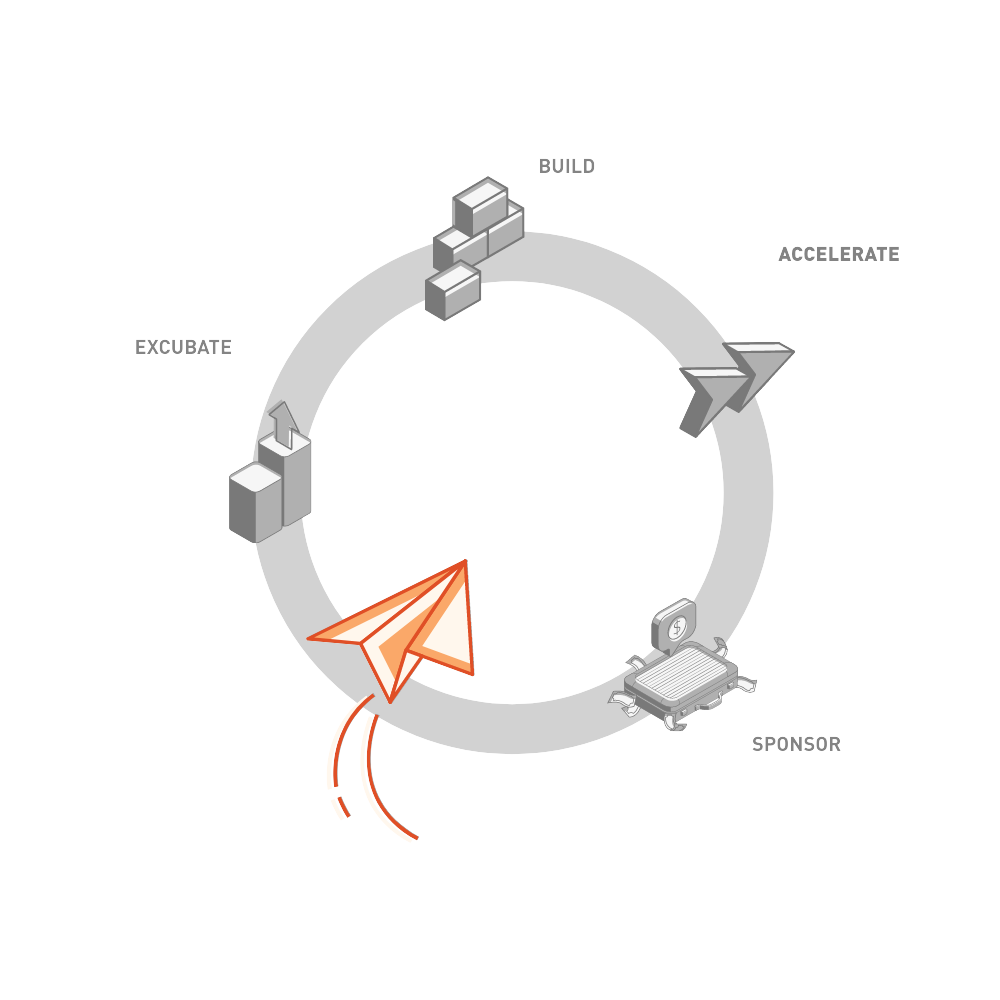

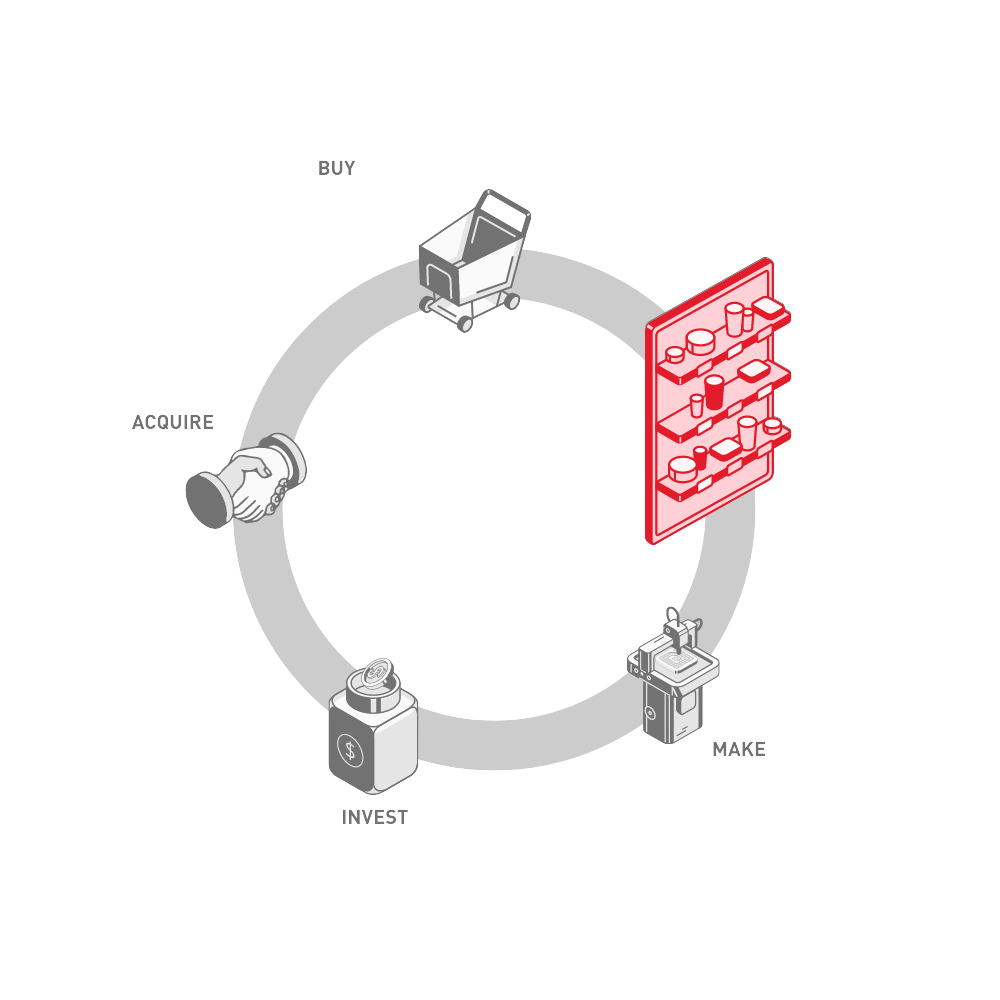

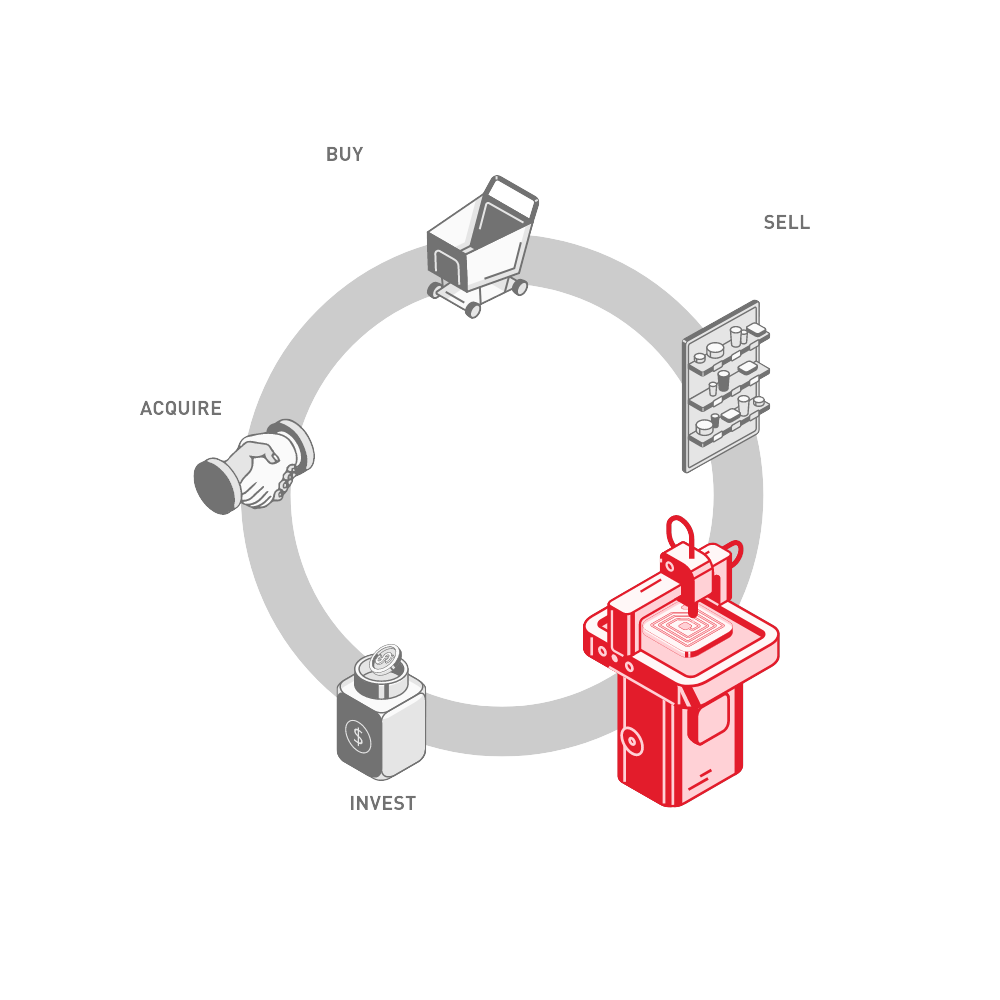

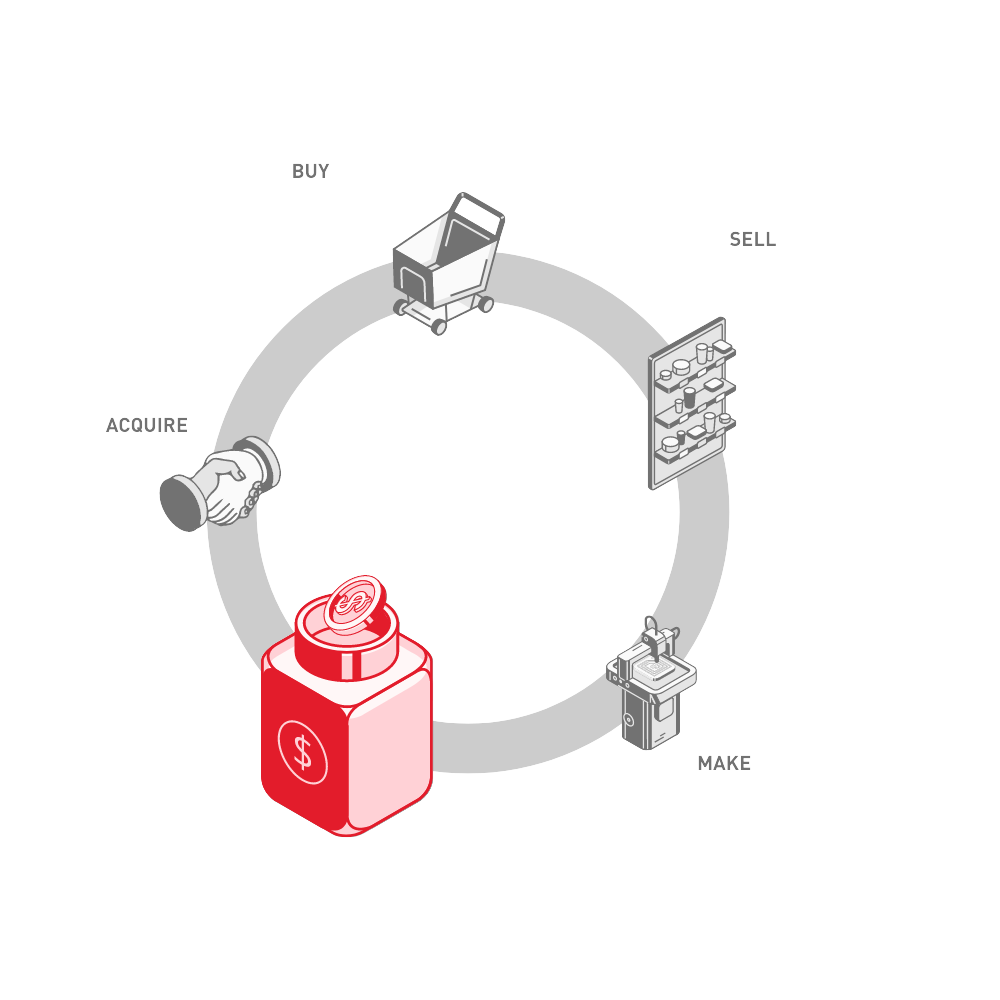

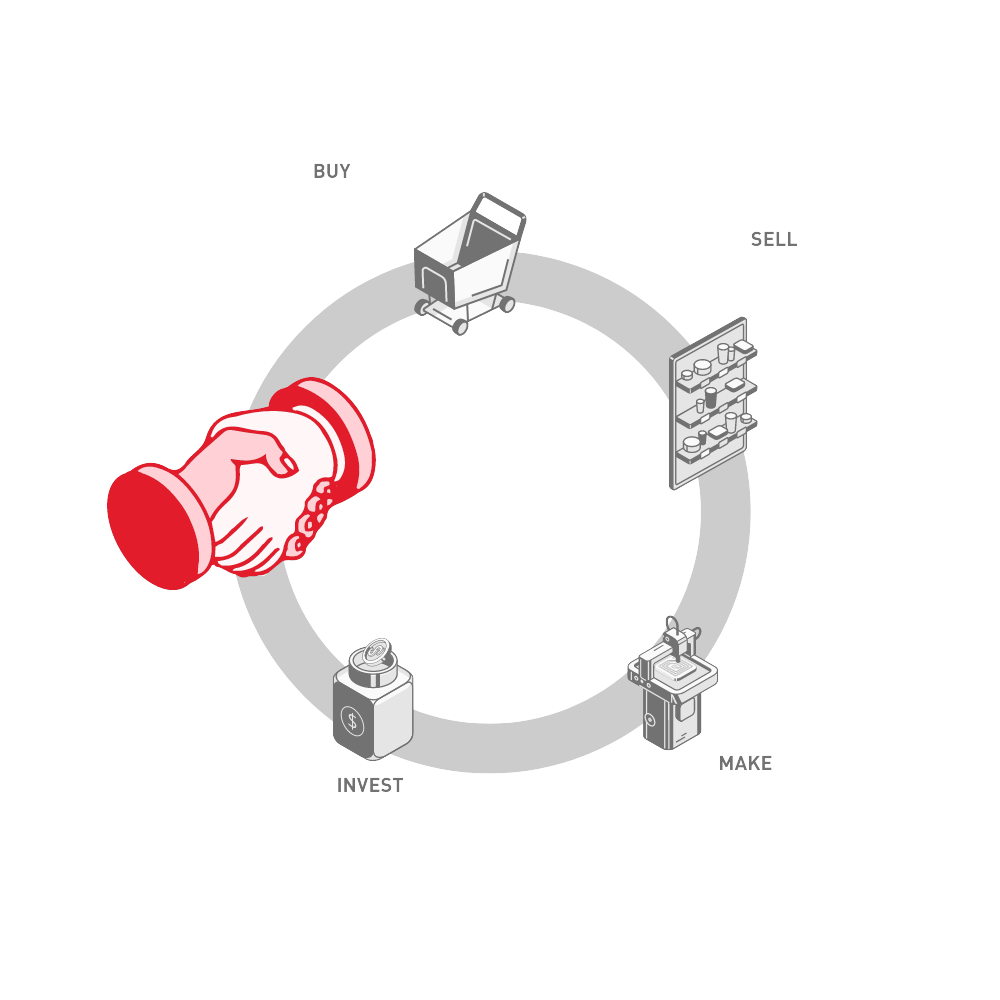

STARTUP PARTNERSHIP MODELS

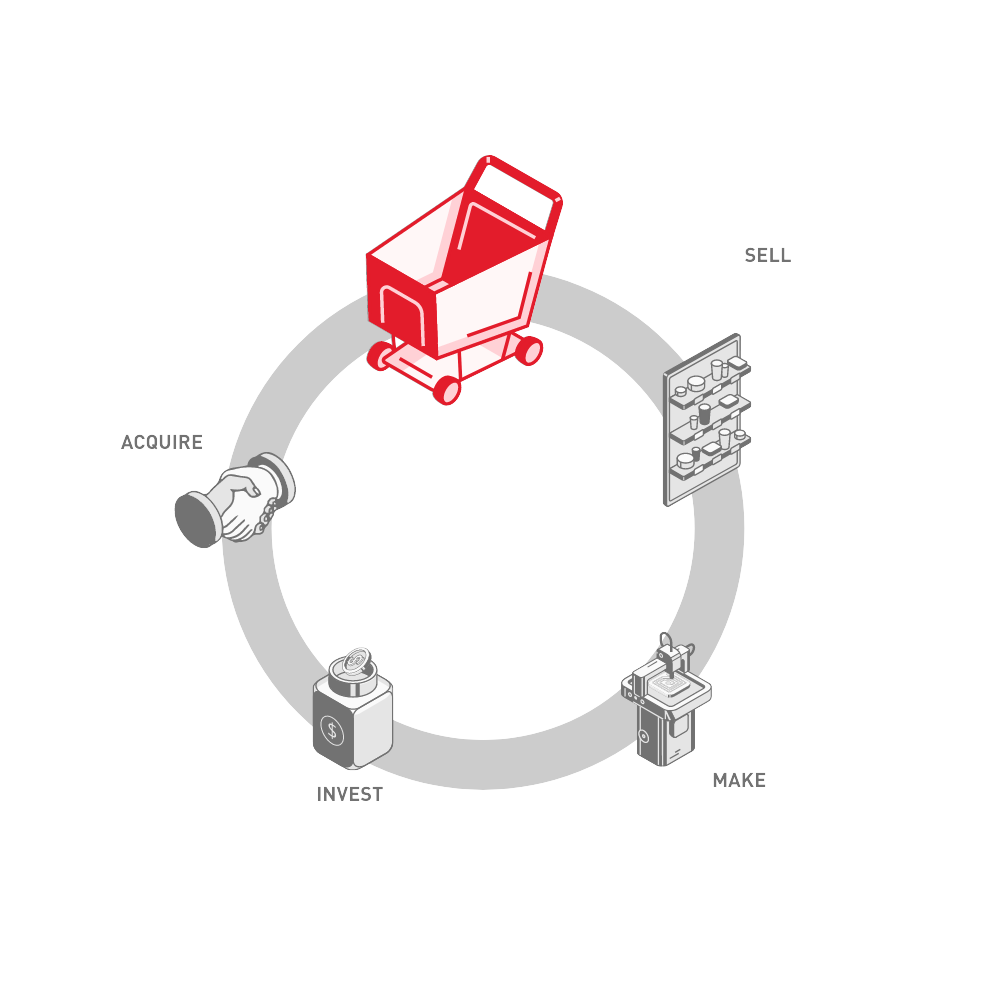

VALUE CAPTUREStartup partnership models power industrial majors to unlock business potential from scale-ready strategic assets, diversifying offerings, scaling futuristic business models, driving inorganic growth in a dynamic market landscape and emerging as winners in the tech dominated future.

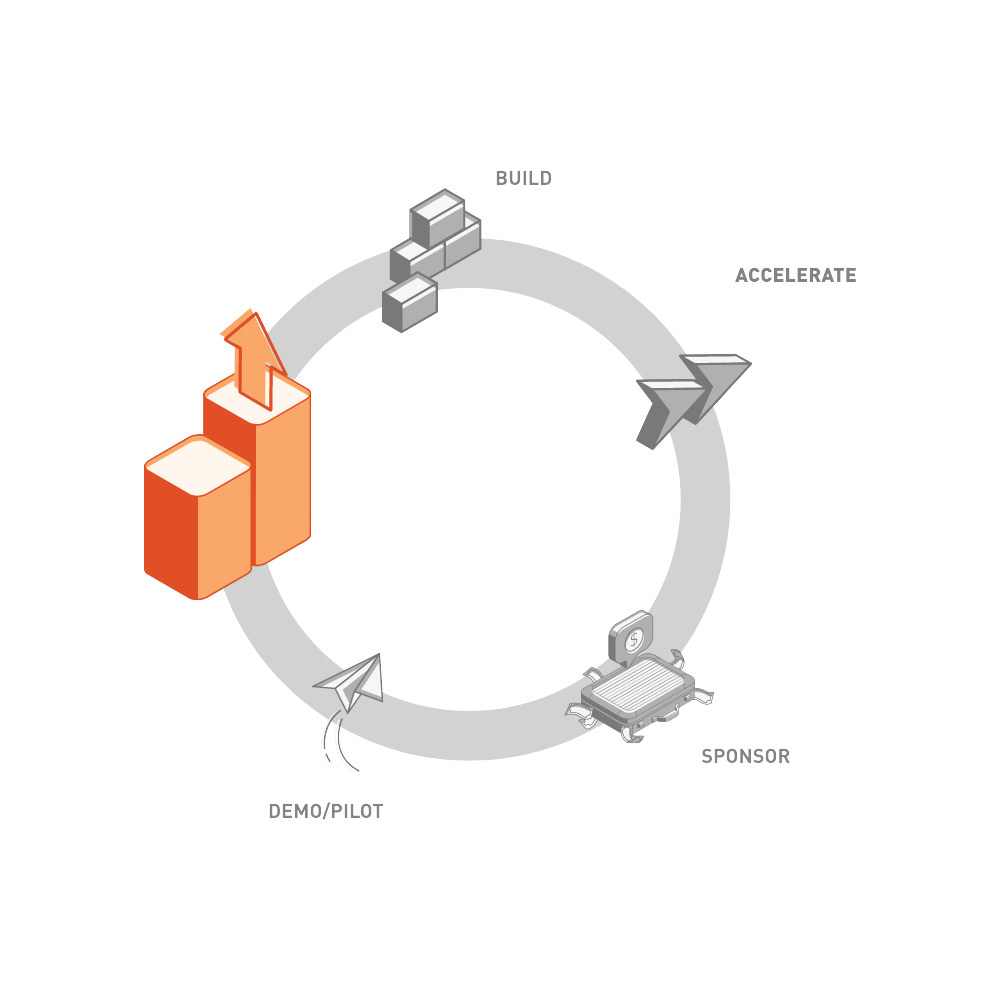

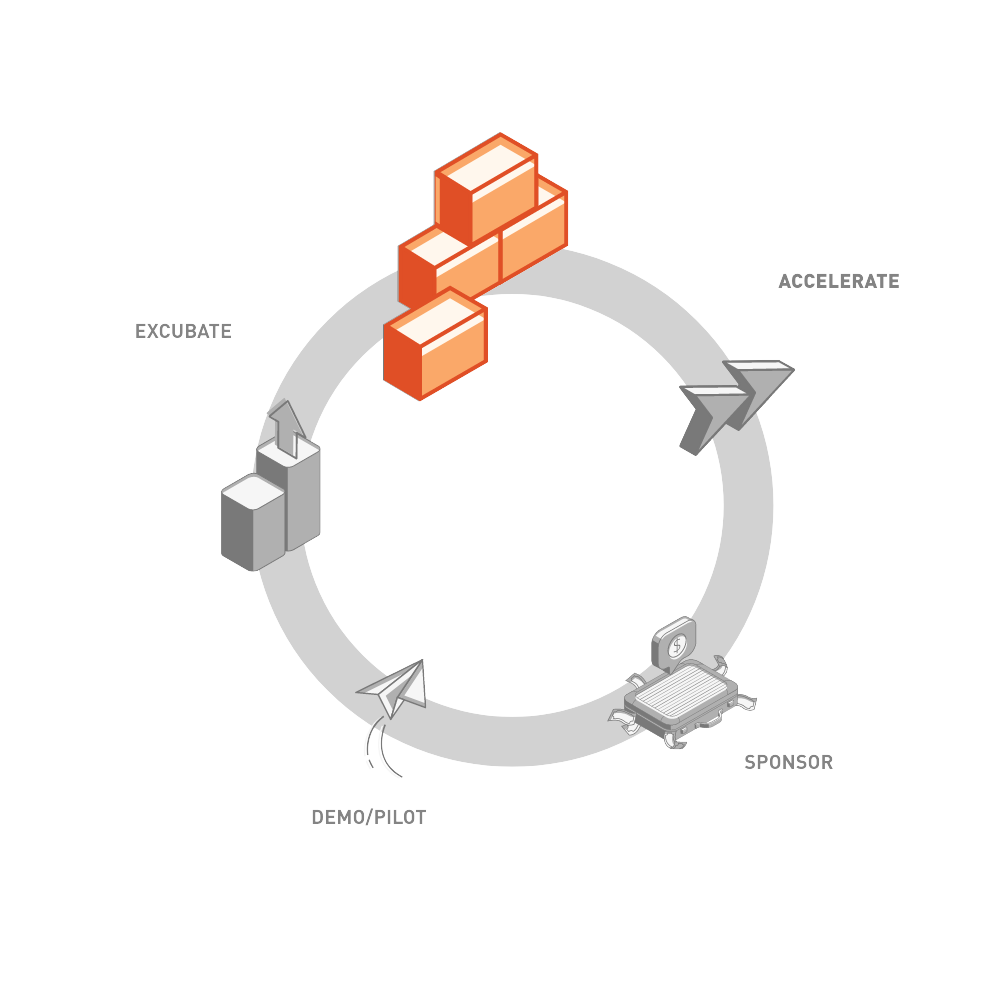

STARTUP ENGAGEMENT PROGRAMS

VALUE CREATIONStartup engagement programs enable industrial majors to tap into entrepreneurial innovation for building long-term competitive advantage, generating disruptive business value from emerging technologies, and creating strategic assets for investment and growth.

.png)